December 2023 Update

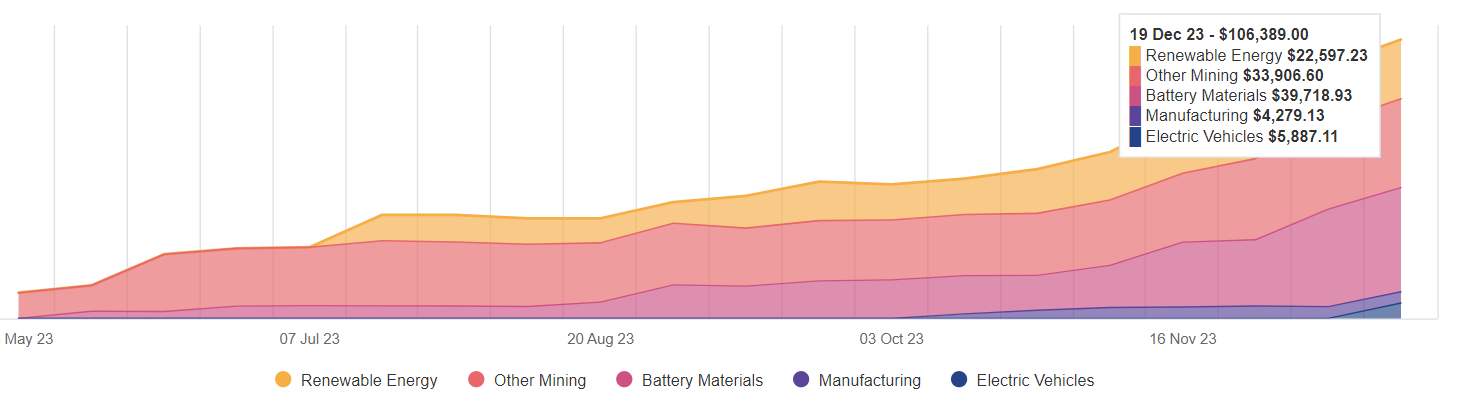

We're 7 months into The Clean Energy Investor portfolio and have hit more than $100k AUD invested! The last quarter of 2023 has provided a great opportunity to invest in companies in the Wind Energy, Battery Materials and Green Mining sectors, as well as smaller investments in Heat Pump and Electric Vehicles manufacturers. There's been too many investments to cover individually in this blog, so this is a high level summary of the investments made over the last 6 months.

Wind Energy

A larges investment was made Orsted (ORSTED.CSE), the largest developer of offshore wind energy projects in the world, as the share price plummeted due to a write-down in their North American development projects. The drop in market cap was far larger than the impact of these projects leading me to believe the company was undervalued.

A smaller investment was made in Vestas (VWSB.FRA), one of the largest manufacturers of wind turbines globally as industry sentiment eroded due to rising interest rates, cost inflation and cancellation oof projects.

Battery Materials

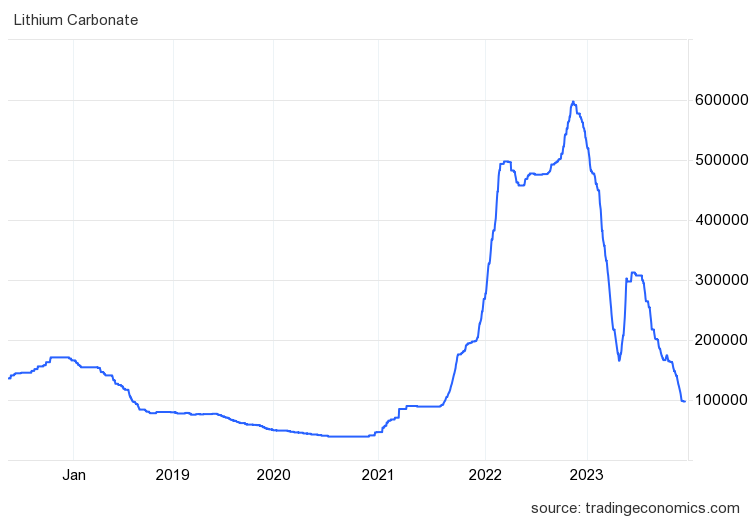

The spot price of Lithium (Spodumene, Carbonate and Hydroxide) saw a large and sustained drop from the very high highs of late 2022. This appears to be due to an oversupply of Lithium in the market, due to a lot of new mines coming on line, and negative sentiment about the future of electric vehicles. The future of EVs still seems bright (see further in the EV section below) and the world is still likely to be under supplied Lithium in the medium to long term.

The drop in Lithium price caused a drop in the share price of many Lithium producers and so I went buying. Over $40k AUD was invested in the following Lithium Producers:

- Gangfeng Lithium (002460.SHE)

- Albermarle (ALB.NYSE)

- Core Lithium (CXO.ASX)

- Develop Global (DVP.ASX)

- Lithium Americas (Argentina) Corp (LAAC.TSE)

- Lithium Americas Corp (LAC.TSE)

- Liontown Resources (LTR.ASX)

- Pilbara Minerals (PLS.ASX)

- Patriot Battery Materials (PMET.CNSX)

- Sociedad Quimica Y Minera de Chile S.A. - ADR (SQM.NYSE)

Green Metals

A large investment was made in Fortescue Metals Group (FMG.ASX) as the likely first iron ore miner to electrify and produce green iron/steel. Fortescue Future Industries also owns rights to the largest portfolio of green energy projects in the world. Andrew 'Twiggy' Forrest, the founder and CEO of FMG, appears highly motivated to decarbonise FMG, the Iron Ore industry and the world.

A decent sized investment was made in Bellevue Gold - the first producer of 'Green Gold' from a mine mostly powered from renewable energy.

Heat Pumps

A small investment was made in Panasonic, manufacturer of heat pumps (domestic) and EV batteries (Tesla's battery producer at Fremont).

Electric Vehicles

Although growth in EVs was lower than expected in 2023, EV sales still grew by circa 30% compared to 2022. Incumbent US, European, Japanese and Korean manufacturers performed dismally in EV sales, which is where the EV doom and gloom probably emanated from. As with other major technology shifts it appears the incumbents will be the losers and new entrants will take the market (think Apple vs Nokia when smartphones became a thing). Global EV market leaders are Tesla and BYD (which I own in other portfolios) and a long tail of lesser known Chinese brands.

A small investment was made in Rivian Automotive (RIVN.NASDAQ), the US manufacturer of electric pickup trucks (Utes). Historically I thought these were vapourware but I saw a few of them in the US on a recent trip and they look like a great car.

A small investment was made in Nio (9866.HKG) a small Chinese EV manufacturer for similar reasons.