Rio Tinto

June 2023 | ASX:RIO

Rio Tinto is a company well positioned to capitalise on demand for green metals. It's also a company a lot of readers will be familiar with (often for the wrong reasons), may be investors in, and is one of the most commonly held stocks in Australia.

Introduction

Rio Tinto is an Anglo-Australian multinational company that is the world's second-largest metals and mining corporation (behind BHP). The company was founded in 1873 when a consortium of investors purchased a mine complex on the Rio Tinto, in Huelva, Spain, from the Spanish government.

The company underwent considerable expansion and change in the 20th century. Rio Tinto's growth was driven by a series of mergers, acquisitions, and joint ventures. For instance, in 1995, it merged with CRA Limited, an Australian diversified mining company, forming a dual-listed company. In the late 1990s and early 2000s, Rio Tinto also acquired major aluminium industry players, significantly expanding its operations in this sector.

In the 21st century, Rio Tinto has been increasingly committed to environmental sustainability and ethical business practices. However, it has faced controversies related to environmental damage and the treatment of indigenous peoples. For example, in 2020, the company faced backlash for the destruction of the 46,000-year-old Juukan Gorge cave sites in Western Australia during an iron ore extraction operation.

Rio Tinto currently producers three major metals, and is in the process of making these green metals. It has also recently started developing a Lithium mine to enter the battery material space.

Iron Ore

Iron Ore is by far Rio Tino's biggest contributor to revenue and profit, and has been for at least 15 years. In the first half of 2023 Rio Tinto earned USD $5.8 Billion from Iron Ore. This is essentially dirt (with ~65% FeO3 content) dug up in the Pilbara in Western Australia, hauled hundreds of kilometres on Rio Tinto railway line and then loaded onto ships and two Rio Tinto ports. Rio Tinto is the largest Iron Ore producer in Australia and second only to Vale of Brazil with ~30% of the seaborn Iron Ore market. This Iron ore is turned into steel in blast furnaces throughout North Asia, responsible for ~6% of global greenhouse gas emissions.

Copper

Rio Tinto is one of the largest copper producers in the world, with its Kennecott mine in Utah and part ownership of Escondida, in northern Chile, the world’s largest copper mine. It produces around 1.2 million tonnes a year, accounting for 5.5% of global production. Rio Tinto is also developing Oyu Tolgoi, in the South Gobi region of Mongolia, is one of the largest known copper and gold deposits in the world. When the underground mine is complete, it will be the fourth-largest copper mine in the world. Copper is mostly used for electrification and is projected to grow as the world electrifies.

Aluminium

Rio Tinto has low carbon Alumina smelting and Aluminium refining operations in Canada (hydro), Iceland (hydro) and New Zealand (hydro). It also has high carbon operations in Australia that are planned for decarbonisation this decade.

Lithium

Rio Tinto purchased the Rincon Lithium project in Argentina in 2022, currently under development, with production expected at the end of 2024. Rio Tino also owns one of the largest undeveloped Lithium deposits in the world, the Jadar project in Serbia. In 2022 the Government of Serbia cancelled the 'Spatial Plan' of the mine, halting any development.

Financials

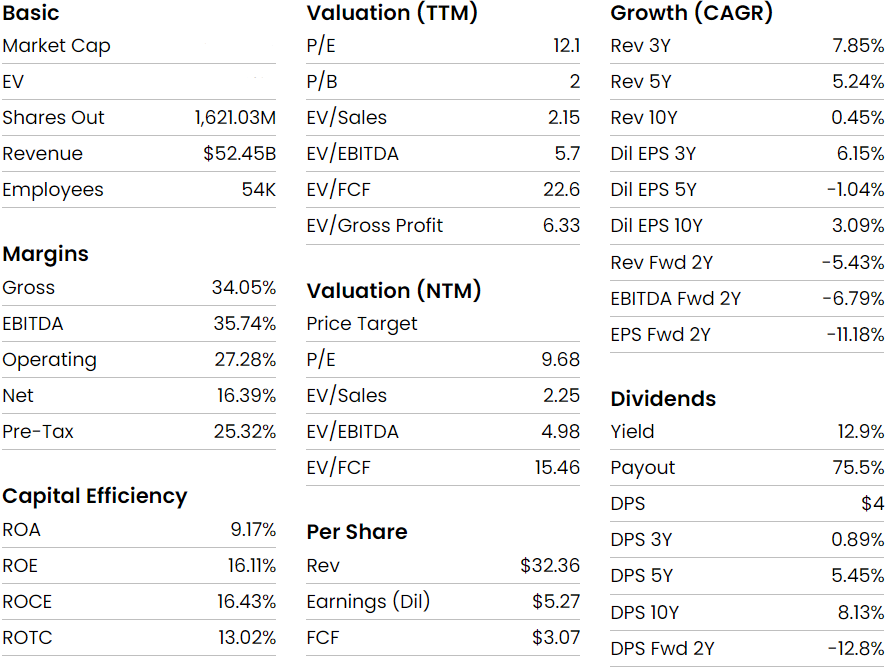

Rio Tinto has a large market cap of $165B with very little debt. The company is highly profitable, has a high dividend yield and the current price to earnings ratio is low relative to other listed stocks.

Most of Rio Tinto's current earnings and free cashflow come from their iron ore operations in Australia. Iron Ore is a highly profitable business, even at current prices of $108 USD/tonne. Rio Tinto's production costs are in the order of AUD $20/tonne, leaving more than $90/USD per tonne of profit for what is essentially rocks with minimal downstream processing. Rio Tinto produces more than 350 million tonnes of iron ore p.a., which equates to a very big dollar value. Rio's competitive advantage in Iron Ore is their rail network and ports to transport the ore from inland in the Pilbara, to the cost and then onto a ship for export.

Although Rio Tinto is one of the largest copper producers in the world, copper contributed only USD $0.3 Billion to earnings in H1 2023 due to lower prices in 2023. Similar to copper, aluminium contributed only a small amount to Rio Tinto's earnings and (USD $0.2B) and its use will grow with electrification.

Why I Bought

I purchased Rio Tonto stock (ASX.RIO) in June 2023 for the following reasons.

Green Metals

As one of the largest producers of Iron Ore in the world, Rio Tinto has the opportunity to reduce world emissions by around 1% - not many companies can have such an outsized impact. Currently, Iron Ore from Western Australia is shipped to Northern Asia and combined with coking coal from Queensland in a blast furnace to produce Iron which is then formed into steel. It is the eblast furnace that producers the bulk of the emissions with the Carbon from the coking coal (converted to CO) combining with the Oxygen in the Iron Ore (FeO3) to produce Fe and CO2, with Billions of tonnes of the latter being produced each year.

However, coking coal can be replaced by Hydrogen or potentially just electricity, to reduce the Iron instead, releasing water or oxygen instead of carbon dioxide. So long as the Hydrogen and/or electricity is produced with renewable energy then massive emissions reductions can occur. The best bit is that this can all occur in Australia, adding mor value and jobs by shipping green iron from Australia rather than Iron Ore and coal. In addition to a shit load of Iron Ore, the Pilbara is blessed with some of the best renewable energy resources in the world. (the 26 GW Asian Renewable Energy Hub is one example of this potential).

Although this is many years away from fruition, Rio Tinto has shown some leadership in this area by:

- Starting to trial green steel from hydrogen production

- Starting to power mine sites with renewable energy

In addition to these (small) efforts in Iron Ore, Rio Tinto are making bigger strides in their other two current major metals.

In Copper, Rio Tinto have announced construction of a hydrogen pilot plant to trial lower-carbon alumina refining in Gladstone, Qld.

In Aluminium, Rio Tinto have committed to supplying the Aluminium assets in Queensland with up to 4 GW of wind and solar by 2030. (Their aluminium assets in Canada and New Zealand are already powered by clean hydro-electric energy).

Battery Materials

The world needs a lot more Lithium over the next decades to power Lithium ion batteries in electric vehicles and stationary energy storage. Rio Tinto is well positioned to supply this through their Rincon Lithium project and potentially Jadar. Importantly, they have a extremely strong balance sheet that can support the building and scaling up of additional Lithium resources, something a lot of the other Lithium producers don't have.

Risks

The major risks with this company are:

Risk #1 - Social license

In 2020 Rio Tinto blew up >46,000 year old Aboriginal rock shelters in Junkan Gorge in Western Australia to save a few million in mining cost. In 2021 there were mass protests and the eventual cancellation of Rio Tinto's Jadar Lithium project in Serbia. Rio Tinto must improve their practises if they want to maintain social license and continue to mine.

Risk #2 - No/slow progress in green steel

A trial is a start, but that was a year ago and we need to decarbonise super quickly. There is a risk Riot Tinto does not move quickly enough on green steel and will be disrupted by a company that moves faster.

Risk #3 - Poor acquisitions

Rio Tinto is renowned for making terrible acquisitions and, although it appears this may be behind us with the current leadership group, it may happen again. To name a few of these poor acquisitions:

- Alcan - USD $38B

- Mozambique Coal - USD $3.7B