Goldwind

July 2023 | SZSE:002202

Goldwind is a Chinese wind turbine manufacturer and currently (2022) the world's largest producer of wind turbines by volume (GW). It appears to be at a discount due to decreasing revenue and increasing costs of production. We are going to need a shit tonne of wind turbines to decarbonise and Goldwind is well positioned to produce a lot of these.

Introduction

Goldwind Science & Technology Co., Ltd., more commonly known as Goldwind, was founded in 1998 in Urumqi, Xinjiang, China. The company's focus from the outset has been on renewable energy solutions, specifically wind turbine manufacturing and services.

In its early years, Goldwind benefited from the Chinese government's push for renewable energy. The company capitalized on these opportunities, developing and refining its turbine technology. In 2007, Goldwind was listed on the Shenzhen Stock Exchange, which further fuelled its growth and expansion.

One of the key moments in Goldwind's history came in 2002 when it entered into a technology transfer agreement with Vensys, a German wind turbine manufacturer. This deal provided Goldwind with direct-drive permanent magnet technology, a significant leap forward in wind turbine technology that resulted in more efficient and reliable turbines.

Over the years, Goldwind has continued to expand globally. By 2015, it had become the largest wind turbine manufacturer in China and one of the largest in the world. The company has developed projects on six continents and continues to innovate, offering a wide range of wind turbine products and solutions to meet varying customer needs.

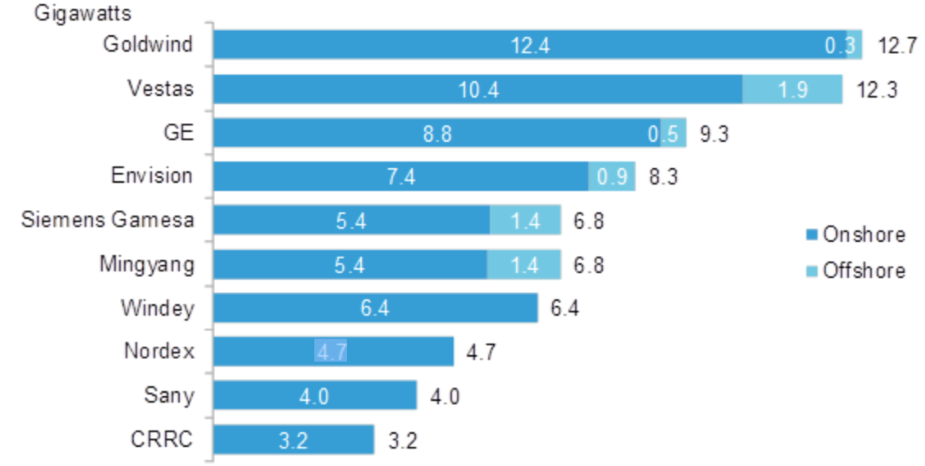

As of the year 2022 (the most recent year of data), Goldwind is the largest manufacturer of wind turbines in the world, inching out Vestas by 400 MW. Goldwind produced 12.4 GW of onshore wind turbines (#1 producer), however they only produced 0.3 GW of offshore wind turbines (#6 producer). This small market share of the offshore market is a concern because offshore wind energy is expected to grow rapidly over the next decades.

Financials

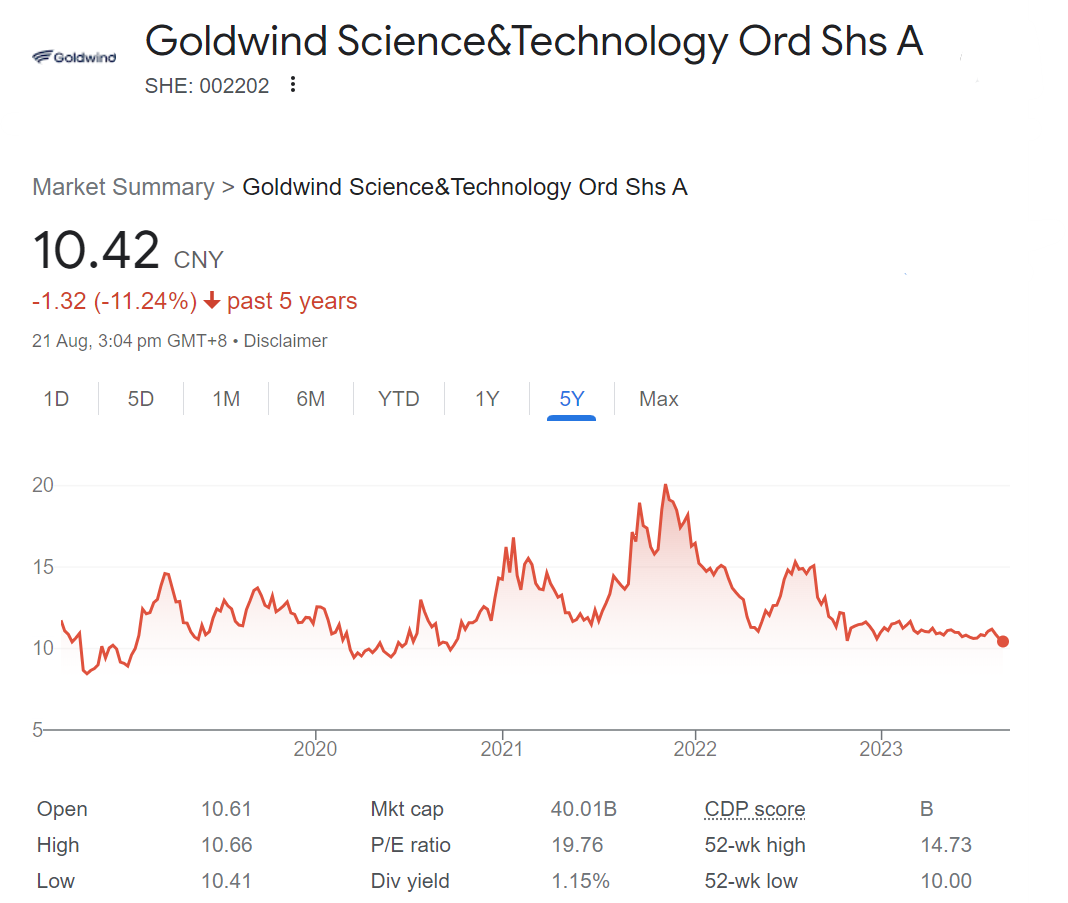

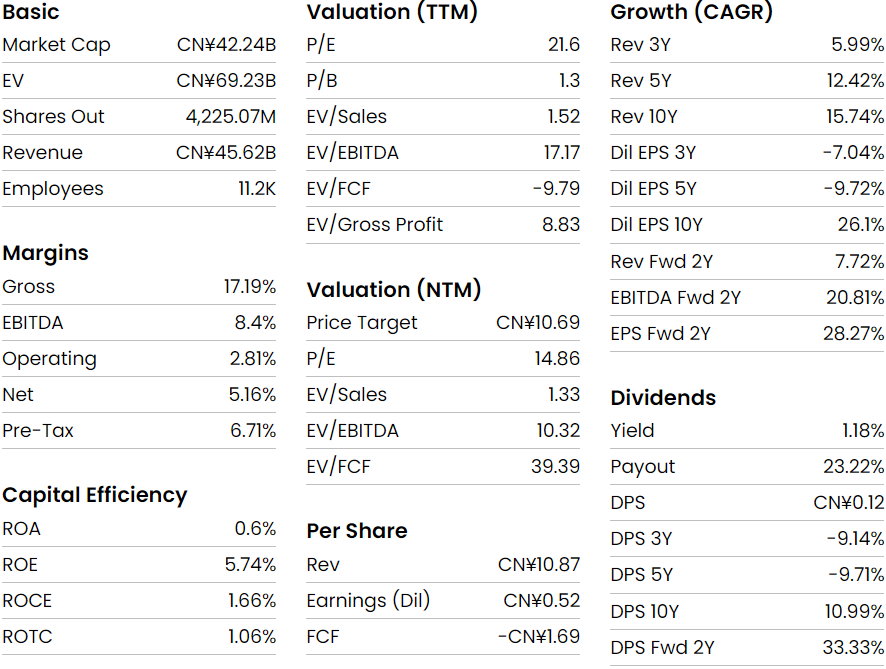

At the time of writing, Goldwind has a market cap of CNY ¥42.24 Billion, which is equivalent to around AUD $9 Billion, but an Enterprise Value of ¥69.23 Billion which means they have a lot of debt (¥69B). The company's current price to earnings of 21.6 is not overly high given growth potential of the wind energy industry and is projected to fall to ~15 in the next 12 months as revenue grows again.

It has been a tough few years for the win industry in general as projects were delayed or disrupted due to the COVID-19 and have been exposed to escalating costs due to inflation, particularly in steel and shipping. These increased costs cannot typically be [assed on, resulting in decreased profit for each project. Despite still being profitable, profitability has declined in the latest period, worrying investors resulting in a sell-off in the companies shares.

Why I bought

I bought Goldwind as I believe it currently trades at a discount to it's growth potential and to its market peiers. If wind energy continues to grow, even modestly, Goldwind should be able to profit from this by supplying a portion of the wind turbines required.

I expect wind energy to keep growing robustly and growth may even accelerate over time if offshore wind costs can be brought down and/or if the climate emergency results in a impetus to accurate deployment onshore and offshore. Goldwind is the largest producer in the world, and is therefore likely to maintain a large chunk of this future growth.

Goldwind trades at a large discount to its Western peers who have been hit with same issues as Goldwind. Vestas Wind Systems (#2 producer) has a market cap equivalent to AUD $40B (4x that of Goldwind) and made a loss in the most recent period.

Risks

Risk #1 - Losing technology edge.

Wind turbines are extremely high tech and customers will pay big money for an improvement in tiles or reduction in capex. If Goldwind falls behind in technology they could lose sales. The next frontier in wind is offshore and Goldwind appears to be behind in this area.

Risk #2 - Getting distracted

Recently Goldwind have branched into into water treatment and there is a risk that this distracts them, taking resources (people and money) away from their core wind turbine focus.

Risk #3 - is this a real company?

There have been some companies, including some in the clean energy space, that have presented themselves as large profitable companies but then turned out to be fake and lost investors a lot of money. I can safely say that this is not the case with Goldwind:

- They have developed many projects in Australia

- They have a physical office here

- I've met people who work there and have friends that can vouch for them as real people.

Risk #4 - Geo-political risk

This has happened recently to companies such as Alibaba and Tencent and is a risk that will always be present so long as significant revenue comes from China. This could come in the form of the company not winning contracts in China or being fined for some reason.

The other side of the coin is non Chinese governments impeding the success of Goldwind. This could be in the form of tariffs, preferential treatment of local manufacturers or an outright product ban. There's a China-US trade war and Goldwind could be collateral damage.